Trending Now

REVIEWS

How to use local SEO service to rank your business quickly...

Local SEO service is very important to rank your local service or business effectively as the search engine optimization by local SEO service is...

GADGETS

Knowing about the risks and damages of black hat SEO techniques

Most of us know about the SEO but the term "black hat SEO" is new for many bloggers that refer the wrong tactics and...

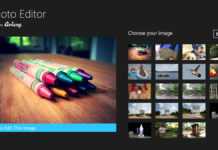

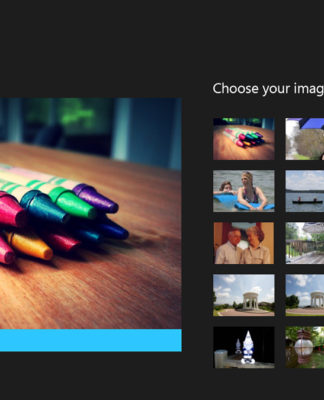

Tips to select the best picture on the internet for your blog post

Here we are going to tell some effective tips to select the best picture on the internet for your blog post. If you are...

Top SEO tips 2017 and tricks that will be trending this year

The year 2017 is about to start and it is expecting some more strong В SEO tips 2017 and tricks. All webmasters and bloggers need...

Infinite Load Articles

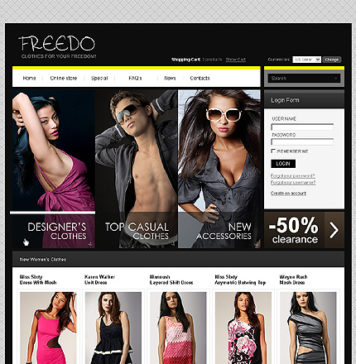

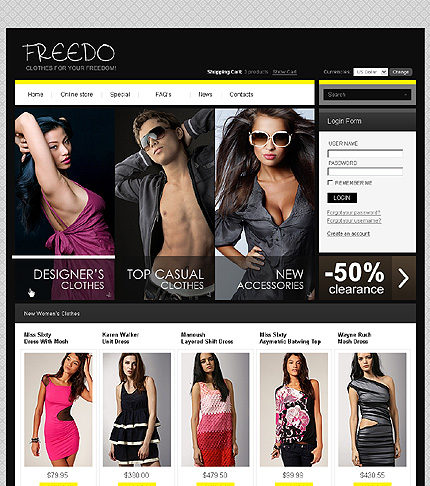

Tips and tricks to become a successful fashion blogger in 2017

Welcome to my blog, you are here because you were searching the tips and tricks to become a successful fashion blogger in 2017.We have...

Knowing about the risks and damages of black hat SEO techniques

Most of us know about the SEO but the term "black hat SEO" is new for many bloggers that refer the wrong tactics and...

Tips to select the best picture on the internet for your...

Here we are going to tell some effective tips to select the best picture on the internet for your blog post. If you are...

Top SEO tips 2017 and tricks that will be trending this...

The year 2017 is about to start and it is expecting some more strong В SEO tips 2017 and tricks. All webmasters and bloggers need...

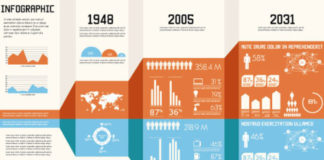

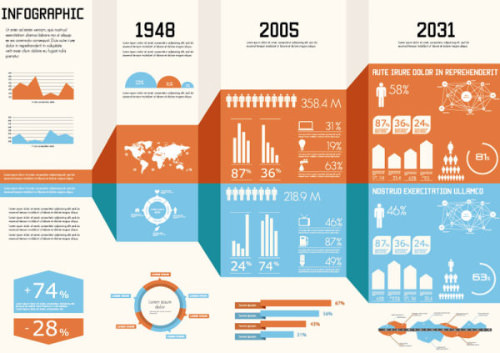

How to use the Best infographics to boost your SEO in...

SEO is not only to fill your website with content stuffing but now you need best infographics to boost your SEO in 2017.The old...

Niches and blog topics that are famous and profitable for 2017

Here we are giving some niches and blog topics that are famous and profitable for 2017 that will help you if you want to...

MOST POPULAR

Tips and tricks to become a successful fashion blogger in 2017

Welcome to my blog, you are here because you were searching the tips and tricks to become a successful fashion blogger in 2017.We have...

ANDROID

Tips and tricks to become a successful fashion blogger in 2017

Welcome to my blog, you are here because you were searching the tips and tricks to become a successful fashion blogger in 2017.We have...

Knowing about the risks and damages of black hat SEO techniques

Most of us know about the SEO but the term "black hat SEO" is new for many bloggers that refer the wrong tactics and...

DESIGN

Tips and tricks to become a successful fashion blogger in 2017

Welcome to my blog, you are here because you were searching the tips and tricks to become a successful fashion blogger in 2017.We have...

GADGETS

Knowing about the risks and damages of black hat SEO techniques

Most of us know about the SEO but the term "black hat SEO" is new for many bloggers that refer the wrong tactics and...

Tips to select the best picture on the internet for your blog post

Here we are going to tell some effective tips to select the best picture on the internet for your blog post. If you are...

Top SEO tips 2017 and tricks that will be trending this year

The year 2017 is about to start and it is expecting some more strong В SEO tips 2017 and tricks. All webmasters and bloggers need...

PHOTOGRAPHY

Trending Now

MOST POPULAR

Tips and tricks to become a successful fashion blogger in 2017

Welcome to my blog, you are here because you were searching the tips and tricks to become a successful fashion blogger in 2017.We have...

ANDROID

Tips and tricks to become a successful fashion blogger in 2017

Welcome to my blog, you are here because you were searching the tips and tricks to become a successful fashion blogger in 2017.We have...

Knowing about the risks and damages of black hat SEO techniques

Most of us know about the SEO but the term "black hat SEO" is new for many bloggers that refer the wrong tactics and...

DESIGN

Tips and tricks to become a successful fashion blogger in 2017

Welcome to my blog, you are here because you were searching the tips and tricks to become a successful fashion blogger in 2017.We have...

GADGETS

Knowing about the risks and damages of black hat SEO techniques

Most of us know about the SEO but the term "black hat SEO" is new for many bloggers that refer the wrong tactics and...

Tips to select the best picture on the internet for your blog post

Here we are going to tell some effective tips to select the best picture on the internet for your blog post. If you are...

Top SEO tips 2017 and tricks that will be trending this year

The year 2017 is about to start and it is expecting some more strong В SEO tips 2017 and tricks. All webmasters and bloggers need...

PHOTOGRAPHY

Trending Now

DON'T MISS

SEO tricks 2017 to rank your blog higher in search engines

In this article, we are giving some В SEO tricks 2017 for your blog as it is very important to know that SEO strategies and...

Why most of the Google Algorithm Updates remain unnoticed ?

Google releases its minor and major changes through some updates off and on that are called Google Algorithm updates but according to a trend...

TECH AND GADGETS

Why we should use high pr social bookmarking site list for...

Social bookmarking is very important thing for SEO as every website needs good traffic and rank that is not possible without social bookmarking 2017...

TRAVEL GUIDES

FASHION AND TRENDS

How the guest post in shoutmeloud helps in growing our online...

In this article, we will tell you about how the guest post in shoutmeloud help in growing our online audience but before that, you...

Making money on Amazon as Affiliate is the best online work...

Making money on Amazon is quite simple as Affiliate Amazon is an easy and successful way to make money at home because Amazon Affiliate...

LATEST REVIEWS

Tips and tricks to become a successful fashion blogger in 2017

Welcome to my blog, you are here because you were searching the tips and tricks to become a successful fashion blogger in 2017.We have...